With Swyft Books, customers can outsource their accounts and information with out worrying about accuracy or reliability. The professional team manages accounts for every enterprise through their intuitive internet app. The platform helps small businesses to handle their books effectively. Additionally, the straightforward web app facilitates efficient collaboration between companies and accountants. The finance app prioritizes goal setting, which is essential to achieve monetary success. The firm used a broad selection of applied sciences, together with Swift, Java, Laravel, and so forth., to supply such distinctive providers.

These techniques are essential for businesses of all sizes, offering efficient monetary administration, accurate knowledge, and tax compliance. They also present insightful financial data to help better decision-making. The finance industry is undoubtedly expanding, and it’s at the forefront when it comes to new tech adoption and swiftly adapts to the speedy pace of change. This catalyzes the expansion of new businesses and attracts extra shoppers. This trade consists of enterprise funds, banks, investment platforms, and buying and selling platforms. Almost each firm on this sector needs to invest in monetary software program improvement.

MongoDB, a NoSQL database, is often employed when coping with unstructured information and scalability. Oracle, known for its enterprise-level database solutions, is favored in giant financial institutions for its reliability and in depth options. Financial planning applications cater to each people and businesses, providing budgeting, forecasting, and financial goal-setting features.

The customized monetary software leveraged software program development companies to supply such robust services. Managing funds may be daunting whether or not you’re a person or a business proprietor. But AI-driven monetary software development can automate many of these tasks. You can automate transaction recording, accounts reconciling, and report generation. This automation saves you priceless time and reduces the danger of errors.

Millennials and Gen Z are open to new financial developments to take pleasure in automated providers. Concept Usher is a pioneering IT firm with a definite set of services and solutions. We goal at offering impeccable providers to our shoppers and establishing a dependable relationship. Our technical specialists supply a free consultation to assist you plan your thought, requirements, and tokenomics earlier than beginning growth. You want to make sure it’s safe from the beginning, whenever you first write the code, and keep it up even after the software program is getting used. Starting off by following these guidelines saves time, lowers the chance of issues, and helps avoid the additional price of fixing issues later when you don’t comply with the rules.

Strong communication is essential to building profitable relationships. Beforehand, only a customer and its financial institution might entry financial knowledge. Nevertheless, with open banking, a buyer can authorize a third-party to entry its data.

Among these providers, you can choose whichever suits your objectives essentially the most and fine-tune the creation process to fulfill your expectations 100 percent. Technological developments in cybersecurity will require organizations to concentrate on creating enhanced security standards which defend financial information and uphold customer belief. Stakeholders and developers can obtain collaboration by way of open communication with end-users, which allows the developed software program to fulfill business wants and consumer necessities. Software Program design that enables business expansion ensures its sustainability in the lengthy run. Speedy and reliable operations should at all times accompany optimized performance, tolerating excessive transaction volumes. Moreover, automated buyer help powered by AI-enabled chatbots provides around-the-clock assistance, enhancing the overall consumer expertise.

It enhances efficiency and reduces enterprise costs, making it a significant tool for companies seeking to optimize their finances. Financial software automates processes and reduces the possibility of errors, growing efficiency. It provides entry to monetary data to support decision-making.

Fintech Software Program Growth Methodology – Step-by-step Guide

Amongst many others, expertise revolutionizes the fintech industry, too. Learn this information to know every thing about FinTech software program development along with its sorts, features, real-life use instances, and advantages. Building financial software is a tedious endeavor, requiring business experience and a transparent roadmap. By adhering to these steps, companies can create options which would possibly be safe, user-centric, and in a position to scale.

Fintech Software Market Statistics

As an entrepreneur, you may have a transparent imaginative and prescient of the problems you need to solve with your app. Nevertheless, figuring out the MVP features that may check the market and make your app stand out from the competitors can be daunting. With the guidance of execs, you can be sure that your app has the necessary features to succeed. The Electronic Fund Transfer Act is ruled by the Client Monetary Safety Bureau, which takes care of electronic cash transfers through ATMs, POS terminals, and debit cards. This compliance goals to guard customers in case of transaction errors like funds getting transferred to the incorrect account. With use instances like Distributed Ledger Technology, Crypto Change, NFTs, Decentralized Finance, and KYC, blockchain makes the monetary sector immutable and quick.

In The End, create a real-time communication resolution to increase customer loyalty. Scopic specialists construct unique options that will assist you assist your purchasers through the channel that suits them finest. Reduce risk and enhance your strategic operational processes by working with Scopic to create monetary Software ?onfiguration Management software solutions that scale as you grow.

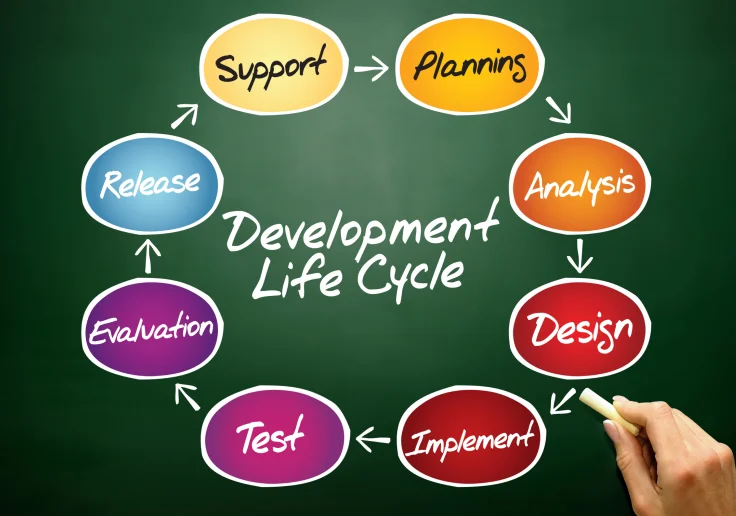

- In a rapidly evolving business, this cycle repeats itself frequently and organizations should maintain pace to survive.

- Alerts can be delivered through SMS, e-mail, push notifications, or in-app messages, guaranteeing users are all the time knowledgeable and prepared to act quickly when wanted.

- And lately, fintech’s quiet evolution became a speedy digital revolution.

- This phenomenon is relatively new and has emerged on account of the growing demand for financial companies to navigate the deep waters of the complicated legal landscape that surrounds this business.

- To get began along with your monetary providers software program development project, get in touch with us instantly.

If you don’t consider AI you instantly run the danger of building an outdated system. The word ‘Fintech’ is a combination of two words, ‘financial’ and ‘technology’. Financial expertise (aka fintech) is any software, utility or piece of expertise that is used in the delivery of economic providers or that is used to improve and innovate financial providers. Yes, the software program may be very easily built-in with other methods, such as CRM tools, ERP software program, cost gateways, and banking APIs. This allows seamless knowledge trade and helps automate varied processes.

In fintech, cloud-based solutions offer flexibility, scalability, and cost-efficiency. They can simplify infrastructure, knowledge storage, and even security challenges. Look at information sovereignty, compliance, and integration capabilities. Or it might possibly just be somebody else’s pc you’re paying to use. It’s booming, reworking how we handle money, from banking to investing. Assume cell banking, on-line payments, and even cryptocurrency.

Implementing sturdy huge information analytics in monetary software program entails the utilization of superior algorithms and machine learning fashions. These technologies allow the identification of hidden correlations, threat components, and emerging alternatives, contributing to extra correct financial software developer companies predictions and proactive threat management. Prioritize industry-leading encryption standards and multi-factor authentication to safeguard sensitive monetary data. Be clear about your dedication to regular safety updates, and contemplate offering reviews that element your safety approach.

Leave A Comment